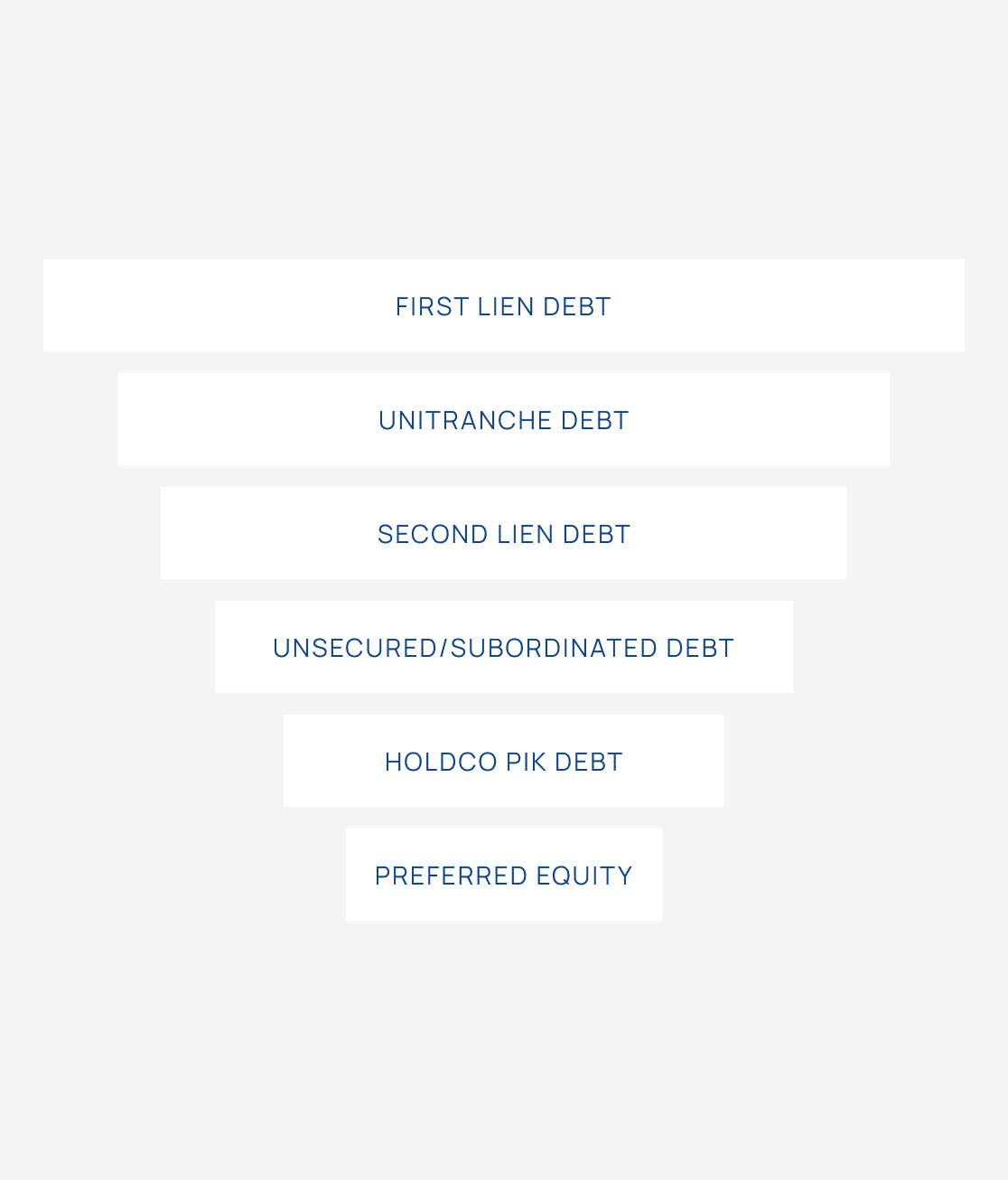

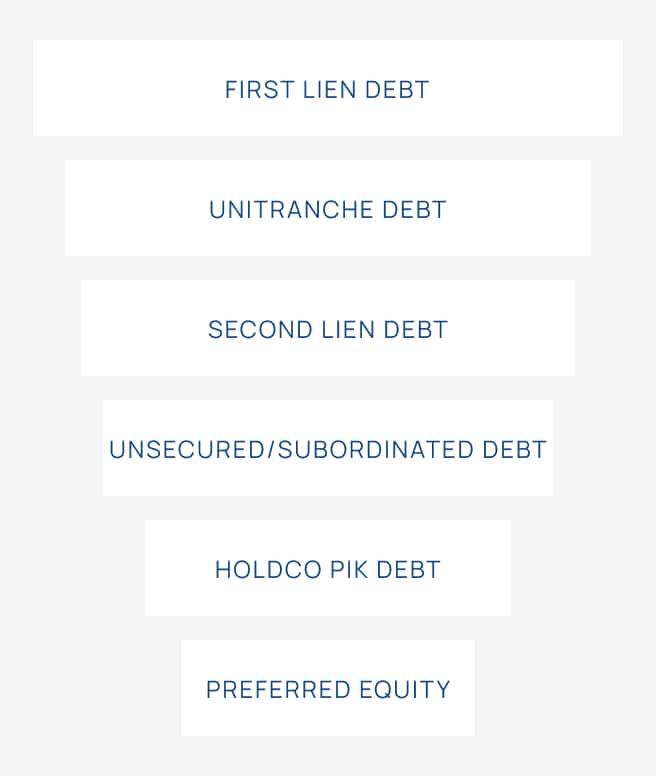

Brinley leverages our team’s deep understanding of credit and experience through multiple cycles to identify what we believe are high-quality investments across the capital structure.

Revenue visibility and predictability through contracts, high switching costs or mission critical applications, coupled with manageable capital expenditures and/or working capital needs.

Leading market positions in end markets with low or no cyclicality that benefit from growing secular tailwinds.

Protected market positions through high switching costs, regulatory barriers, contracted revenues and/or reputational advantages in winning new business.

Borrower downside protection through predictable revenue trends with manageable downside cases; structural downside protection through maximizing risk-adjusted returns via investing in the appropriate position in the capital structure.

We seek to create a portfolio that is resilient in all market environments by focusing on stable industries with limited cyclicality.

All referenced data unless otherwise noted is as of March 31, 2024.

The products, services, information and/or materials contained on this site may not be available for residents of certain jurisdictions.

Copyright© Brinley Partners, LP 2024. All rights reserved. Information on this site is proprietary and may not to be reproduced, transferred, or distributed in any form without prior written permission from Brinley Partners, LP. It is delivered on an “as is” basis without warranty or liability.